February Market Outlook for 2023

- Landon Whitt

- Feb 7, 2023

- 5 min read

January sales numbers are in and here is your market summary of the last 30 days in central Oklahoma and what to look forward to as we enter february.

You Can Also Watch this blog here:

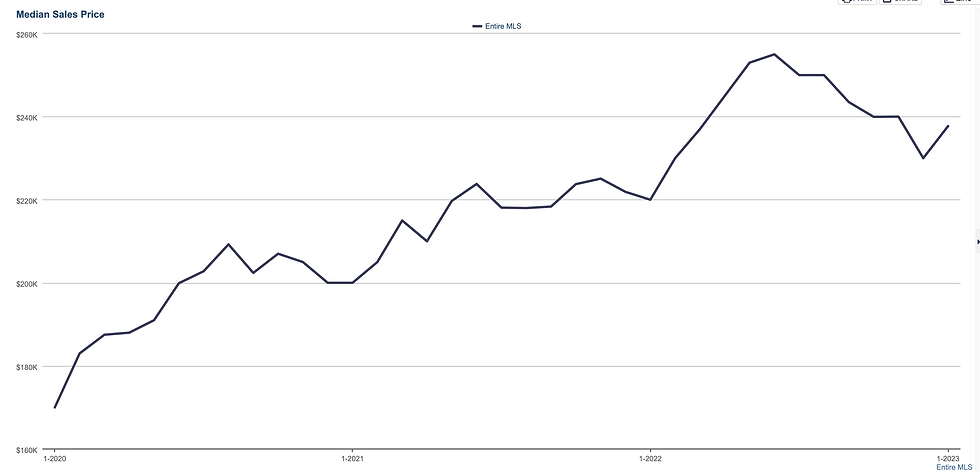

The Median home price has bounced from its bottom in December of 230,000 ending the month of January at 237,730. That marks a 3.3% median price improvement in the last 30 days making january’s year over year improvement 8.1%

Months supply of inventory dropped for the first time in 12 months hitting a low at 2.3 months supply of inventory coming out of January thats 4.4 percent lower inventory than december. This yet another sign that the local market in Central Oklahoma is returning to a more normal seasonal pattern

Shows to pending, hits a new high for the year at 9 showings prior to going under contract across central oklahoma. The last time Central Oklahoma had nine showings to pending was in may of 2022. The total average showings per listing is 5.5 up from 3.5 in december. Which may mean if your getting over 5.5 showings the first 14 days on market going into february you are highly likely to get under contract. Less than 5.5 showings and that's a strong indicator you are overpriced OR have a special property for a special buyer.

Days on market is coming out way up out of January with a 34% increase in time sitting on the for sale side. December ended the month 17 days on market while february ended at 24 days. However to put this into a broader perspective the median days on market pre pandemic for January was around 27 days on market so we are still well below historic seasonal average days on market. This is yet another indicator that OLD windy Oklahoma is returning to the predictable Linear housing market.

Negotiation power? January coming out with the same score for the last 90 days at 100% of list to close ratio, which has held rock steady since March of 2022. Exceptions being the $500k - $1million listings whose median dropped to 99.3 percent of the purchase price. Also the price point below 100k seeing a steep drop to just 93% of the listing price achieved. Now its important to note that these figures do not include the famous buyer asking for the seller to pay their closing costs which have nearly tripled in popularity in offers over the last 90 days. Most loans allow the seller to contribute up to 3% of the purchase price or 6% on an FHA loan and 2% on investment loans. This can be a great incentive for buyers who may want to personalize the home prior to moving in, the savings on closing costs is looked at like free money to overcome objections like removing an above ground pool or repainting that “favorite” bedroom of the seller.

Update on the Oklahoma economy

Latest jobs figures posted february 3rd Oklahoma's unemployment rate is holding steady at 3.4 percent while nonfarm payroll employment adds 2,900 jobs over the month.

As for the Oklahoma state Flower

The U.S. Cannabis Spot Index increased 2.9% ending the month of january at $1,005 per pound. Cannabis Benchmarks U.S. Wholesale Spot Index components rose the first days of february with the weighted average of indoor flower at $2.22 per gram. The weighted average of indoor flower prices ticking up for the fourth week in a row. Greenhouse product’s spot price also ticked higher, breaching the $1,000 level for the first time since November 2022. Outdoor flower’s price is up $9 on the week. The spot index itself fell $7 due to losses in Illinois, Michigan, Connecticut, and Massachusetts.

As for the Oklahoma cannabis Market farmers outlook

While the number of cultivation licenses has been reduced year-on-year, the reality remains that there are still 52 patients for every active cultivator license. The dispensary ratio is 160 patients for every license. In fact, if the Oklahoma Bureau of Narcotics is correct and over 1,000 cultivation licenses are involved in an illegal licensing scheme, the removal of those licenses would still leave the state with too many cultivators for the number of registered patients.

Recent news reports have focused on the “ghost owner” lawyers; attorneys accused of paying off their firm’s employees and others to claim cannabis license ownership, when the licenses were actually owned by an out of state or foreign entity or individual that does not meet state residency requirements (75% of any cannabis license must be owned by an Oklahoma resident). News on 6 reports the Oklahoma Bureau of Narcotics spokesperson Mark Woodward said, “almost 25% of the farms in Oklahoma are potentially operating under the same fraudulent business scheme.” He also noted “well over a 1,000 if not close to 2,000” may be involved in the ghost ownership arrangements.

Presuming enforcement is coming for such operations, the impact on supply in Oklahoma’s medical cannabis market remains uncertain. Licensed cultivators involved in “ghost ownership” schemes may have been selling some or all of their production into the illicit market, which would lessen the impact on supply within the licensed medical system if those growers are shut down.

Oklahomans will vote in March 2023 on whether adult use cannabis should be legal in the state. If the measure passes, it might help alleviate at least some of the oversupply in cannabis and cannabis licenses. The marijuana industry in Oklahoma produces and sells well over a billion dollars in product each year and that's just the official numbers.

In closing, to wrap up this months market outlook or should i say roll up??

Lawrence Yun, NAR's chief economist, expects things will pick up soon. “January was another difficult month for buyers, who continue to face limited inventory and high mortgage rates,” Yun said. “However, expect sales to pick up again soon since mortgage rates have markedly declined after peaking late last year.” In addition to lower rates, home price increases have also slowed, with the median existing-home price up just 2.3 percent year-over-year nationally. That means improved affordability conditions for buyers as the spring home-buying season approaches, which could mean brighter days – and more sales – ahead.”

And no Oklahoma Real Estate Show market report update is complete without a crazy deal of the month. That award goes to the two brokers of 145 N Luther Road in Harrah, Oklahoma. The property was listed by Stan Pennington of Red Mountain Realty who had the property listed for $980,000 and at day 186 on the market, buyers agent Eden Ware of Chamberlain Realty secured the sale with an offer of $11,000,000 dollars. The sale closed January 28th at 167% more than the listing price ringing the bell in mls at just over 8,000 dollars per square foot.

Comments