Eleven Takeaways From the 2022 Profile of Home Buyers and Sellers

- Dec 14, 2022

- 5 min read

Picking up the 2022 Profile of Home Buyers and Sellers can be a daunting task. There are 142 pages of content, and many charts span the 41-year history of the data set. This post helps you wade through some of the more striking changes. Here are a couple of things to note as you dive in:

The data collection period of this report is from July 1, 2021, to June 30, 2022. Over that period, the housing market has shifted from a low-interest rate, low-inventory environment with bidding wars and frenzied activity to a higher interest rate but still low inventory environment.

This report is only among primary residence buyers and does not include investors or vacation buyers. OK, let's dive in!

1. First-time buyers drop to an all-time low of 26% from 34% just a year ago.

There is no question that housing affordability has shut out first-time buyers with the rise in interest rates and home prices. During the data collection period, buyers also saw the lowest inventory in the U.S. since 1999—a picture that impacted first-time buyers more than any other group as investors jumped in. Potential first-time buyers also face a rise in rental costs making it challenging to save for a down payment.

2. The age of first-time and repeat buyers hit all-time highs.

The age of first-time buyers jumped to 36 from 33 years, where it had been for three years. Provided the headwinds first-time buyers faced, this may not be a surprise. Twenty-six percent of first-time buyers reported "difficulty saving for a down payment" was a challenging task in the buying process and cited higher rental costs, car loans, credit card debt, and student debt as factors holding them back. For repeat buyers, the age has risen to 59 years, up from 56 years in last year's report. Americans feel confident taking on a mortgage later in life and purchasing a primary residence. Trades have happened later as tenure in the home has also increased.

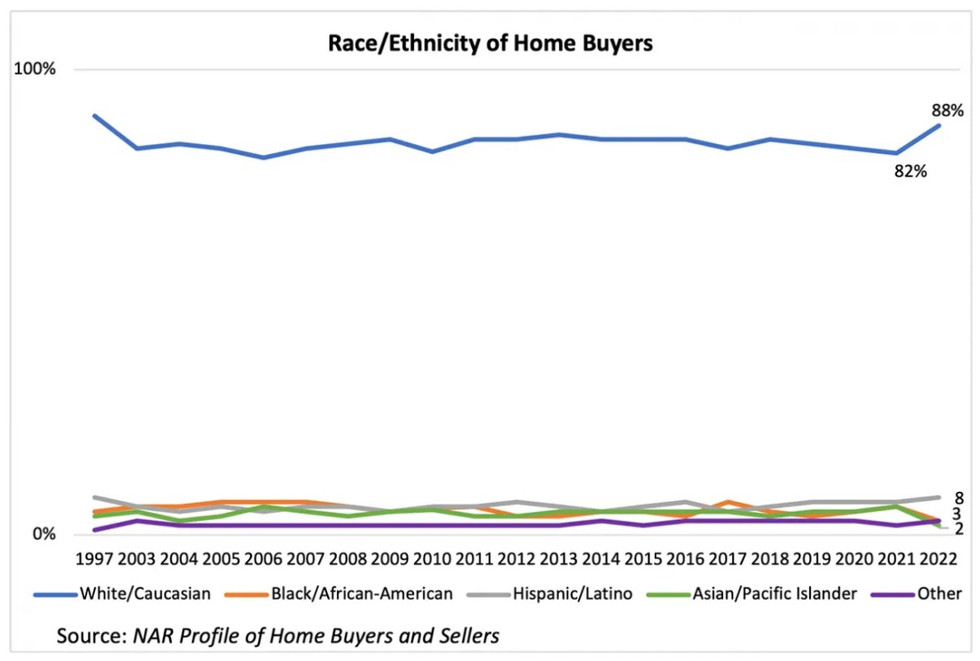

3. The share of White and Hispanic/Latino buyers grew, while Black/African American and Asian/Pacific Islander buyers retreated.

From research produced throughout 2022 by NAR Research, Black/African American renters are paying a disproportionate amount to rental costs. As these rents rise, it is further holding back Black buyers, who are also more likely than others to be first-time buyers. White buyers are most likely to be repeat buyers and to have housing equity to assist them with the down payment of their next property.

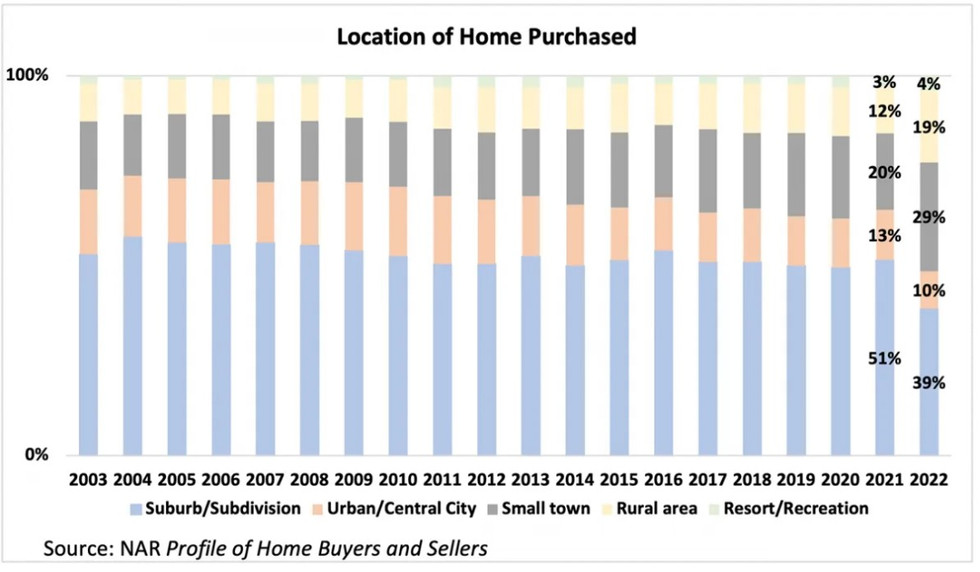

4. Small towns and rural areas saw a migration flow while there was a retraction of buying in urban areas and the suburbs.

Buyers choose their neighborhood based on many factors, but the top of the list was the quality of the neighborhood, affordability, and proximity to friends and family. Small towns and rural areas proved to be the winning dynamic for many when making that choice—affordability was key, and family support systems were just down the street.

5. How far a buyer moved jumped to an all-time high of 50 miles from a range that had been steady between 10 to 15 miles.

Buyers' migration to small towns and rural areas was undoubtedly at play. Another factor is remote and hybrid work settings. In January 2021, many headlines touted that CEOs provided employees with permanent remote work. This allowed buyers to separate themselves from city centers or inner suburbs and migrate to farther areas. Zoom towns were the boom towns in the last year.

6. The share of all-cash repeat buyers jumped from 17% to 27% in the past year.

Homeowners have accumulated tremendous housing equity in the last decade and hold about $210,000. This has allowed many to avoid holding a property mortgage and pay all cash for their purchase. As the location to purchase in small towns and rural areas became more popular in the last year, this may have further allowed buyers to move from expensive areas to more affordable ones. The share of first-time buyers who paid all cash remained essentially unchanged at 3%.

7. Tenure in home, before selling, returned to an all-time high of 10 years.

After a pandemic-driven drop last year to eight years in the home, tenure has risen to an all-time high. Between 1987 and 2008, the typical tenure was just six to seven years before someone made a trade. The top reasons sellers made the change in the last year were to be closer to friends and family, moving due to retirement, and their neighborhood had become less desirable. In past years, moving had been more common due to a change in a family situation or a job relocation.

8. Expected tenure for first-time buyers hits an all-time high of 18 years, up from seven years in 2007.

If a first-time buyer was able to enter the homeownership ladder in the last year, they would have less intention of moving from their home quickly. The expected tenure of first-time buyers even surpasses that of repeat buyers of 15 years. Buyers have locked-in rates in a rising rate environment, which likely plays a key factor. For others, the ability to purchase a home in a less urban area may mean just skipping the starter home altogether. One note is that expected tenure is always longer than actual tenure, as buyers have just finished the tremendous hurdle of finding a home and purchasing.

9. Buyers are diversifying where they pull together the down payment for a home.

Given the rise in home prices, buyers are pulling together funds from multiple sources for their down payment. First-time buyers rely on savings as the primary source, but 22% (down from 28% last year) did use a gift or loan from friends/family, and 15% either sold stocks/bonds or took a loan from their 401k/retirement fund. New this year, 2% of first-time buyers sold cryptocurrency to help with the down payment. While half of repeat buyers used proceeds from the sale of their past home, this does not work for all. Forty-one percent used savings, and 11% even sold stock or took a retirement loan.

10. First-time buyers moving directly from a family member's home into homeownership is at an all-time high.

Twenty-seven percent of first-time buyers had this prior living arrangement, up from 21% the past year. These buyers were able to skip rental increases by moving into a home. This allowed first-time buyers to pay down debt, work on their credit scores and save for a downpayment the way others may not have been able to. The share of first-time buyers who rented before buying dropped to 64% from 73%.

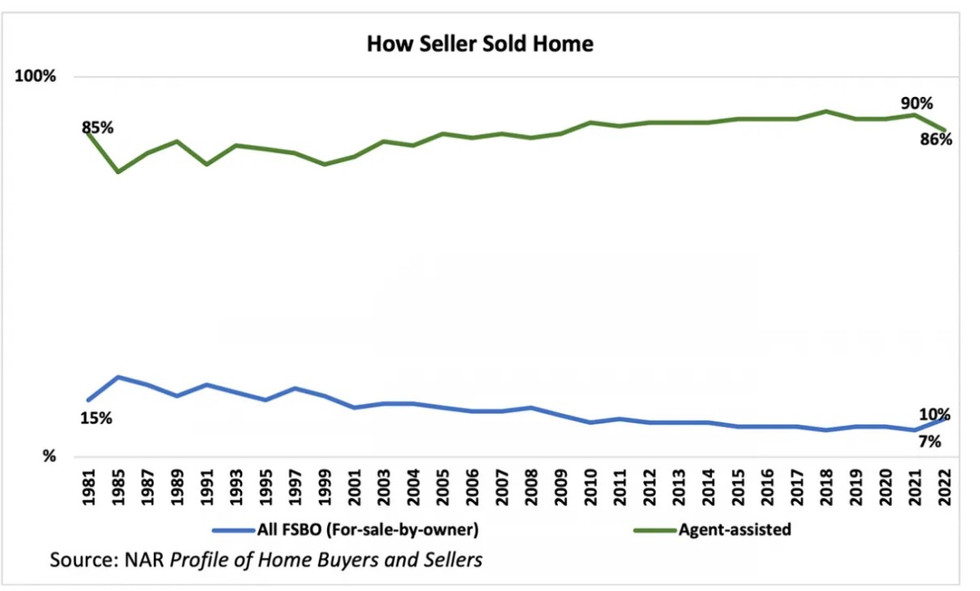

11. Buyers and sellers use and want the help and expertise of a real estate agent.

Eighty-eight percent of buyers used a real estate agent to purchase their home. Buyers are most satisfied with their agent's honesty and integrity, and knowledge of the purchase process. For sellers, 86% used an agent to help sell their home. Sixty-three percent of sellers used an agent that they had worked with before or that was referred to them. Sellers most wanted their agent to price the home competitively, help market the home to potential buyers, and sell within a specific time frame.

Reposted from National Association of Realtors.

Comments